鼎力“碳管易”SaaS产品,通过智能化信息及数据采集,融合国内外主流框架与标准,支持企业实时监测碳排放情况,并生成相应报告。“碳管易”作为企业碳管理的信息化工具,不仅能灵活适配公司不同版块,不同运营区域的管理,也能延伸至上游供应链碳管理以及产品LCA碳排放管理。

鼎力在国家气候战略中心(NCSC)的支持和指导下开发的鼎力碳策数据库,依据TCFD、PCAF等国际权威方法学构建碳排放模型,在自主披露数据基础上辅以产量模型及经济行为模型数据,择优比对,帮助投资者了解发行人碳排放情况、开展组合层面碳测算、满足信息披露要求,助力实现投资组合净零目标。

鼎力提供投资标的碳排放、欧盟SFDR合规指标、公司治理评价指标等在内的一系列ESG数据集,致力于为机构投资者集成最全面、最具实质性的ESG数据,使投资机构从一个数据门户轻松获得特定主题下的所有相关信息,节省数据检索和信息汇总的时间,更专注于深度的研究分析与决策。

鼎力研发了鼎力公司治商(GSG IQ)评价体系,通过三层评分体系、百余项底层指标,全方位地覆盖上市公司治理基本面,为衡量中国上市公司治理水平和可持续发展潜力提供重要的视角,帮助投资者规避潜在的价值投资风险。

鼎力为投资机构与企业客户定制一系列满足合规要求、国际组织规范、客户问询以及市场品宣需要的ESG解决方案,包括为客户量身定做ESG评价体系,辅助研发ESG投资产品策略,境内外ESG合规服务(如SFDR、FMCC),遵循PRI、TCFD等国际组织的战略规划、制度建设和信息披露等。

协助结合国内监管法规与海外最佳实践制定股东大会投票政策,提供重仓股股东大会议案研究报告与投票建议,跟进客户持反对或弃权意见的议案进展并提供风险分析,协助完成投票数据统计,编制分析报告。

鼎力为企业提供基于TCFD等主流框架的气候风险分析、评估及管理。基于企业碳排放基线测算、热点分析,结合适用的管理手段及减排技术,通过可行性、敏感性及财务分析,为企业定制碳中和规划。助力企业积极应对气候风险,把握发展机遇,稳步推进企业碳中和。

鼎力支持企业遵循SBTi标准,制定SBT(科学碳目标)及Net-Zero Target(远期净零目标),以彰显企业低碳发展领导力,更好满足投资者、客户等重要利益相关方的期许。同时,鼎力可基于设定的目标,进行目标分解与路径分析,为企业定制相应的解决方案及实施计划。

11月9日,2023金融街论坛年会发布“中国数字金融独角兽榜单2023”,鼎力可持续数字科技凭借为中国和境外机构投资者提供ESG数据、碳管理SaaS解决方案等服务,以引领绿色金融行业的发展,助力经济高质量发展,从千余家企业中脱颖而出,荣登榜单,入选绿色金融赛道独角兽企业。

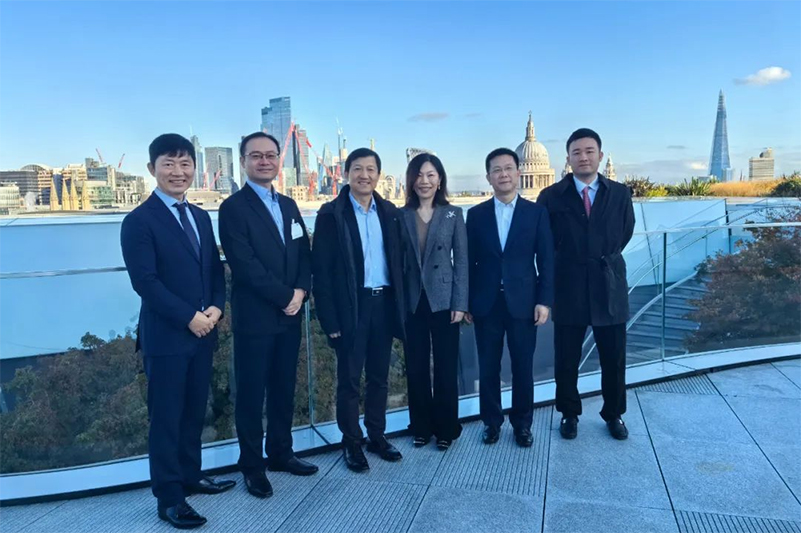

2023-11-072023年10月底,中国证券投资基金业协会(AMAC)带领国内基金业界高管、专家出访英国,与英国资产所有者及资产管理同行开展对话交流活动。鼎力可持续数字科技CEO王德全博士作为中方唯一ESG专业服务机构代表陪团参会。

2023-10-17鼎力可持续数字科技气候变化部负责人、科学碳目标组织(SBTi)技术顾问工作组成员、气候披露标准委员会(CDSB)气候会计标准工作组成员赵俊峰,在大会中重磅推出科学碳管理工具——碳管易TM。

2023-08-238月18日,鼎力可持续数字科技CEO受邀出席招商局集团环境、社会与治理(ESG)工作会议。王德全博士在ESG专题分享中介绍了ESG投资发展历程和发展趋势、解读了海外主流ESG评价体系、分析了招商局集团不同业务板块的ESG核心议题,并结合国内外ESG发展趋势提出了应对策略。

本文为中国证券投资基金业协会绿色与可持续投资委员会工作成果之一,由博时基金管理有限公司和鼎力可持续数字科技(深圳)有限公司完成。具体研究人员包括博时基金王德英、邓灼、董玥莹,以及鼎力公司赵俊峰、李奕熹、王芑丹。中国证券投资基金业协会审校。

2023年9月7日,“助力企业迈向零碳未来——暨工业企业低碳转型研究成果发布会”在北京顺利举办,主要有工业及上下游行业机构、企业代表受邀参会,共同讨论气候信息披露与产业链深度脱碳等关键议题。本次会议同时发布项目阶段性成果报告:《高排放企业气候信息披露指南及指导工具》、《需求侧行动推动原材料低碳转型:实践与趋势》。

目前中国市场上,存在明显的底层资产碳排放数据缺失问题。鼎力统计数据显示,截至2023年6月,共有超1700家A股上市公司披露2022年ESG报告,占全部A股上市公司的30%。而主动披露自身碳数据的A股上市公司只有500多家。其中,数据真正可供投资机构使用的只有282家,占比不足5%。

UNPRI致力于通过鼓励各方采纳责任投资原则,去完善治理诚信和问责机制,并通过解决影响金融市场运作等方面的障碍,建立一个可持续的全球金融系统。从事ESG投资相关业务的机构可以通过提交申请成为UNPRI签署方。成为签署方后,需要遵守UNPRI提出的6项责任投资原则,同时也会获得UNPRI提供的资源支持,包括知识培训,还有一些社区网络等,从而更好地落实ESG投资行为,把ESG纳入到投资决策中。